Introduction :

Imagine a world where your bank operates without tellers, and every financial decision you make is guided by artificial intelligence. Is this the end of traditional banking as we know it?

Historical Background:

The integration of technology into banking is not new. From ATMs in the 1960s to mobile banking apps in the 2000s, the sector has embraced automation to improve efficiency. However, the advent of AI, particularly generative AI, represents a significant leap. By 2024, banks began exploring AI for personalized services, fraud detection, and operational efficiency on an unprecedented scale.

Traditional Bank And AI Technology Contrast, Source: Kore.ai Blog

Economic Analysis:

- Causes:

The rise of FinTech and shifting customer expectations have pressured traditional banks to innovate. AI’s ability to automate processes and analyze massive datasets makes it a natural choice for banks looking to remain competitive. - Events:

Banks have employed generative AI for internal operations like document verification, fraud detection, and credit scoring. Chatbots powered by AI have redefined customer service, providing 24/7 support. - Aftermath:

Early adopters of AI report improved operational efficiency, reduced costs, and enhanced customer satisfaction. However, they also face challenges in integrating AI with legacy systems and meeting strict regulatory standards. - Long-Term Effects:

AI is expected to reshape banking models entirely, pushing traditional banks to adopt hybrid approaches that blend human expertise with AI capabilities. This shift could redefine customer expectations and industry standards.

Regional Impact:

In the EMEA region, where banking systems range from highly digitized (Europe) to emerging markets (Middle East and Africa), AI adoption varies. European banks lead in AI-driven operations, while Middle Eastern institutions see AI as a way to modernize and address challenges like financial inclusion.

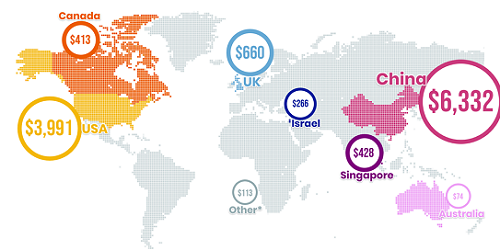

Stron Investment In Smart Building AI led By China, Source: securityworldmarket.com

Geopolitical Connections:

AI’s role in banking cannot be separated from geopolitical trends. For instance:

- Economic sanctions influence how banks use AI for compliance and fraud detection.

- Cross-border transactions and partnerships rely on AI to ensure efficiency and security amidst global trade tensions.

Relatable Examples:

Consider the growing use of AI-powered chatbots by banks like HSBC and Emirates NBD, which provide personalized services akin to a digital banker. Meanwhile, AI in credit scoring has opened up lending opportunities for previously underserved populations.

Conclusion:

AI is not here to replace traditional banking but to redefine it. By blending human expertise with advanced technology, the banking industry is poised for a future where efficiency meets personalization. The question is not if AI will replace traditional banking but how the two will coexist.

Call to Action:

Explore more insights on how AI is transforming the financial world on Martinos & Co. Follow us on Instagram and TikTok for the latest updates and discussions on the future of finance.