Introduction

Investing in 2025 requires a clear understanding of market trends and expert-backed strategies to achieve your financial goals. According to Forbes, the stock market is poised for significant opportunities, with emerging trends shaping various industries. Similarly, insights from NerdWallet and Investopedia emphasize the importance of balancing growth with safety, offering actionable tips to navigate the current financial environment.

This article combines expert advice from these trusted sources, focusing on stocks, high-yield savings accounts, Certificates of Deposit (CDs), and index funds to help you create a well-rounded portfolio.

1. Stocks: Capitalize on Market Trends

Opportunities in the Stock Market

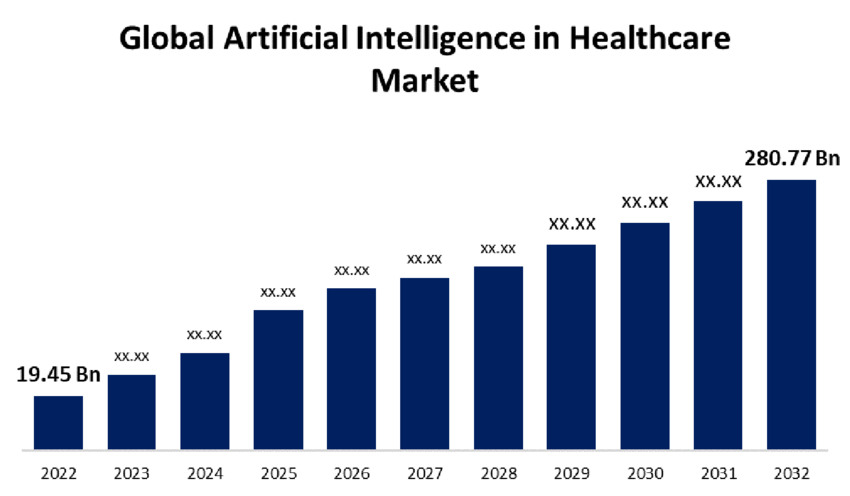

According to Forbes, the stock market in 2025 presents numerous opportunities for growth. Sectors such as artificial intelligence, healthcare innovation, and renewable energy are expected to drive performance. Additionally, industries like financial services and industrials are poised to benefit from technological advancements and global economic shifts. Long-term investors may find attractive returns by focusing on these high-growth areas.

Key Stock Investment Strategies

- Growth Stocks: Focus on companies leading in AI, clean energy, and biotech.

- Dividend Stocks: Reliable for consistent income, particularly in volatile markets.

- ETFs: Broaden exposure by investing in sector or market-wide exchange-traded funds.

Bar Chart Showing Global Artificial Intelligence In Healthcare Market, Source: researchgate.net

2. Explore High-Yield Savings Accounts

Why High-Yield Savings Accounts?

NerdWallet emphasizes that high-yield savings accounts are an excellent option for those seeking low-risk investments. These accounts offer significantly higher interest rates than traditional savings accounts, making them ideal for short-term savings goals or emergency funds. With rising interest rates, these accounts can provide competitive returns while ensuring liquidity.

Benefits of High-Yield Savings Accounts

- Liquidity: Easy access to funds for short-term needs.

- FDIC Insurance: Deposits are protected, ensuring safety.

- Inflation Hedge: Higher interest rates help mitigate the impact of inflation.

According to NerdWallet, comparing APY rates among various banks and avoiding unnecessary fees are key to maximizing returns.

Source: Annuity.org

3. Consider Certificates of Deposit (CDs)

What Makes CDs Attractive?

NerdWallet highlights Certificates of Deposit (CDs) as a secure and predictable investment option in 2025. CDs lock in a fixed interest rate for a set term, making them a stable choice for conservative investors. With interest rates rising, CDs are becoming increasingly attractive, offering higher returns than they have in recent years.

How CDs Work

- Fixed Returns: Guaranteed interest rates that are unaffected by market fluctuations.

- Term Variety: Options range from short-term (6 months) to long-term (5 years or more).

- Penalty for Early Withdrawal: Funds must remain untouched until the term ends to avoid penalties.

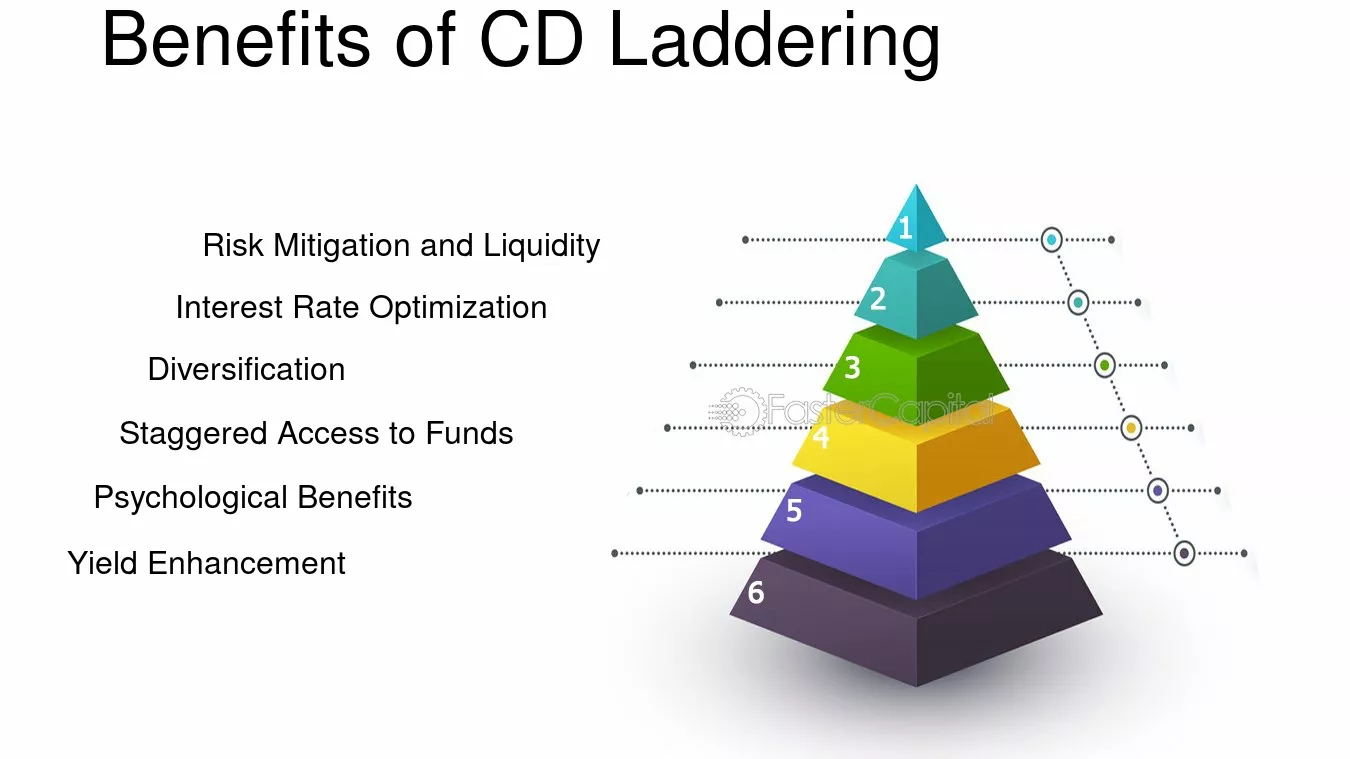

CDs are ideal for those with specific financial goals, such as saving for tuition or a large purchase. NerdWallet advises investors to explore “laddering” strategies—spreading investments across multiple CDs with varying maturities to balance liquidity and returns.

Understanding CD Ladders – Certificate Of Deposit: CD: Ladder Maximizing Returns, Source: fastercapital.com

4. Leverage Low-Cost Index Funds

Why Index Funds Are Essential

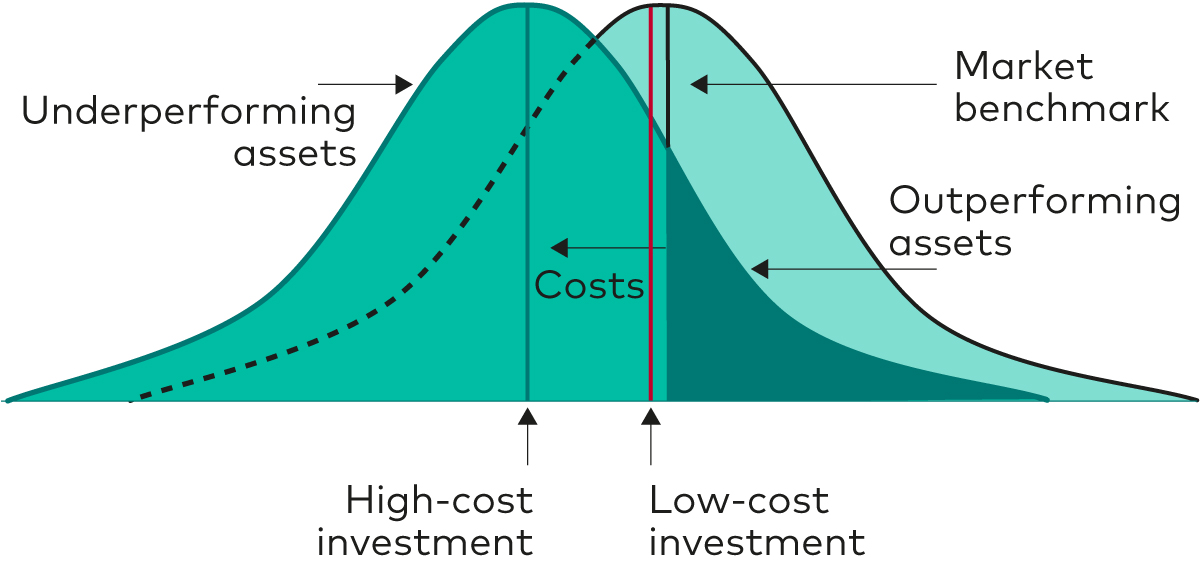

According to Investopedia, low-cost index funds are a practical way to achieve diversification and long-term growth. These funds track major indices, such as the S&P 500 or MSCI Emerging Markets, offering broad exposure to the stock market at a low cost.

Key Benefits of Index Funds

- Diversification: Gain access to hundreds of companies in a single fund.

- Cost Efficiency: Lower expense ratios compared to actively managed funds.

- Reliable Growth: Historically, index funds have delivered consistent returns over time.

Investopedia suggests reinvesting dividends from index funds to take full advantage of compounding and achieve greater growth over the years.

Low-Cost Index Funds Provide Piversified Exposure To Market Leaders, Source: Vanguard

5. Monitor Macro Trends

Key Considerations for 2025

While Forbes focuses on stocks, NerdWallet and Investopedia highlight the importance of adapting to macroeconomic trends. For instance, rising interest rates may impact bond markets, while technological advancements continue to reshape traditional industries. Staying informed and agile is essential for success in 2025.

Conclusion

According to insights from Forbes, NerdWallet, and Investopedia, the best investment strategies for 2025 involve balancing growth-oriented assets like stocks and index funds with secure options such as high-yield savings accounts and CDs. By diversifying your portfolio and staying informed, you can navigate market changes and achieve your financial goals.

Call to Action

For more expert-backed tips and market analyses, visit our website and subscribe to our newsletter.