Introduction: The Easiest Way to Start Investing

Have you ever wondered how the wealthiest investors grow their money over time? The answer often lies in index investing, and one of the most popular indices to invest in is the S&P 500. This guide is designed for beginners, explaining what the S&P 500 is, why it’s a great investment, and how you can start investing step by step.

By the end of this guide, you will have a clear roadmap to confidently invest in the S&P 500, avoid common mistakes, and maximize your potential returns.

What is the S&P 500?

The S&P 500 (Standard & Poor’s 500 Index) is a stock market index that tracks the performance of the 500 largest publicly traded companies in the United States. Some of the most well-known companies in the index include Apple, Microsoft, Amazon, Google, and Tesla.

It was created in 1957 and has since become one of the best indicators of the U.S. economy’s overall health. Investors prefer the S&P 500 because it offers diversification, stability, and long-term growth potential.

Why Invest in the S&P 500?

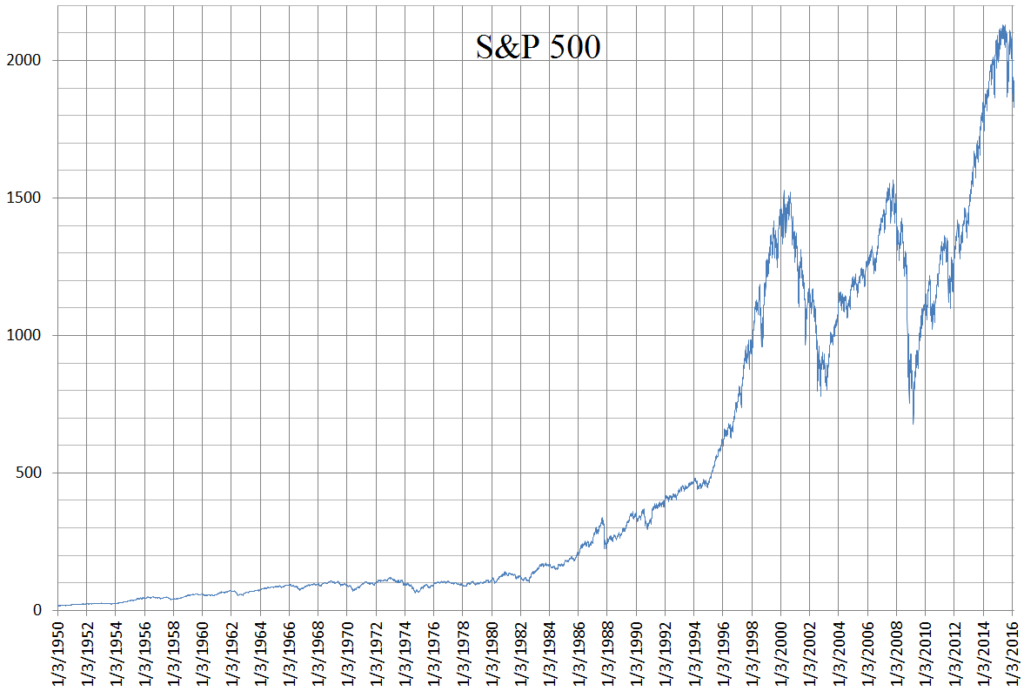

- Strong Historical Performance: The S&P 500 has provided an average annual return of about 10% over the long run.

- Diversification: By investing in the index, you get exposure to 500 companies across multiple industries, reducing risk compared to investing in a single stock.

- Low Maintenance: Unlike picking individual stocks, an S&P 500 investment requires minimal research and management.

- Great for Long-Term Investors: Ideal for those saving for retirement or long-term financial goals.

A Historical Chart Showing The Growth Of The S&P 500 Over The Last 60 Years, Source: Wikipedia

How to Invest in the S&P 500: Step-by-Step Guide

Step 1: Choose a Brokerage Account

A brokerage account is needed to buy stocks or ETFs that track the S&P 500. Some of the best beginner-friendly platforms include:

- Vanguard (Low fees, great for long-term investing)

- Fidelity (Best for U.S. investors, zero commission)

- Interactive Brokers (Best for international investors)

- Robinhood / Trading 212 (Easy-to-use apps for beginners)

Step 2: Open and Fund Your Account

- Create an account with your chosen broker.

- Fund it via bank transfer, debit card, or direct deposit.

Step 3: Choose Your S&P 500 Investment Option

There are three main ways to invest in the S&P 500:

1. Exchange-Traded Funds (ETFs) (Best for Beginners)

ETFs track the performance of the S&P 500 and trade like stocks. Popular options include:

- SPDR S&P 500 ETF (SPY) – Most actively traded ETF

- Vanguard S&P 500 ETF (VOO) – Lower expense ratio

- iShares Core S&P 500 ETF (IVV) – Great for long-term investing

2. Mutual Funds

Mutual funds work similarly to ETFs but trade only once per day at the market close.

- Fidelity 500 Index Fund (FXAIX)

- Vanguard 500 Index Fund (VFIAX)

3. Fractional Shares (Great for Small Investors)

- Some brokers allow you to invest small amounts (even $1) into an ETF or mutual fund without buying full shares.

Step 4: Buy Your S&P 500 Investment

- Search for the ETF ticker symbol (e.g., VOO, SPY, IVV).

- Enter the amount you want to invest.

- Choose “Market Order” (to buy immediately) or “Limit Order” (to set a price at which you want to buy).

- Click Buy and confirm your purchase.

Step 5: Hold and Reinvest

- Leave your investment to grow over years or decades.

- Consider automatic reinvestment of dividends to maximize compound growth.

- Invest consistently over time using a strategy called dollar-cost averaging (DCA).

A simple illustration of dollar-cost averaging over time, Source: U.S. Bank

Understanding the Risks of Investing in the S&P 500

While the S&P 500 is considered one of the safest investments, there are still risks to consider:

- Market Volatility: The stock market can experience sharp short-term drops, even if it performs well over the long run.

- Economic Downturns: Recessions or financial crises can lead to temporary declines in the S&P 500.

- Inflation & Interest Rates: High inflation and rising interest rates can negatively impact stock prices.

However, historical data shows that long-term investors who stay in the market tend to see positive returns.

Final Thoughts: Is the S&P 500 Right for You?

Investing in the S&P 500 is a great choice for beginners looking for a safe, diversified, and historically reliable way to grow wealth. If you are willing to invest consistently and hold for the long term, this index fund is an excellent foundation for your portfolio.

Call to Action: Start Investing Today!

If you’re ready to start investing in the S&P 500, follow these steps:

- Open a brokerage account with a platform that fits your needs.

- Choose an ETF like VOO, SPY, or IVV.

- Invest consistently and hold for the long term.

Want to learn more about investing and finance? Follow Martinos&Co. for expert financial insights and analysis!

Disclaimer: Investing involves risk, and past performance does not guarantee future results. Always do your own research or consult with a financial advisor before making investment decisions.