Introduction

Low-cost index fund investing has revolutionized portfolio management, offering simplicity, cost-efficiency, and long-term reliability. Vanguard’s extensive research solidifies the advantages of this strategy, making it a compelling choice for investors worldwide. This article examines why index funds continue to gain popularity and why they may be the right choice for your financial goals

The Principles of Index Investing

1. The Zero-Sum Game Theory

The market’s aggregate return equals the asset-weighted return of all participants. This implies that for every investor outperforming the market, another must underperform. Over time, active managers face a near-impossible task: consistently outperforming while managing higher costs.

Market Participants’ Asset-Weighted Returns From A Bell Curve Around Market’s Return, Source: Vanguard

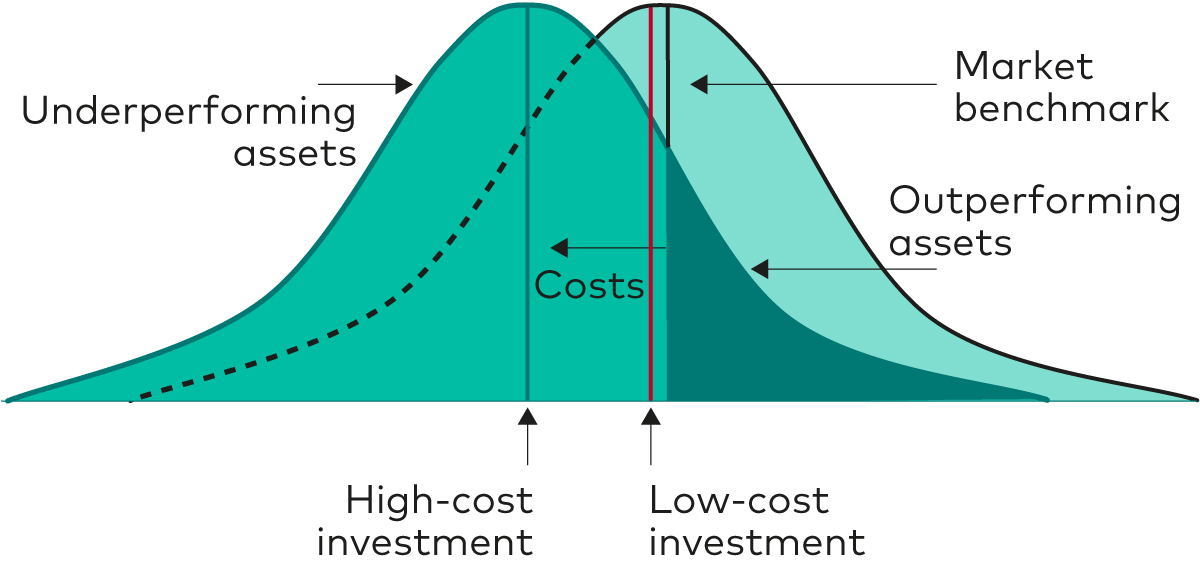

2. The Effect of Costs on Performance

Costs such as management fees and trading expenses erode investor returns. Vanguard’s research clearly shows that high-cost investments move the performance curve further left, reducing the chances of outperforming the market. In contrast, low-cost index funds significantly mitigate this drag.

Market Participant Returns After Adjusting For Cost, Source: Vanguard

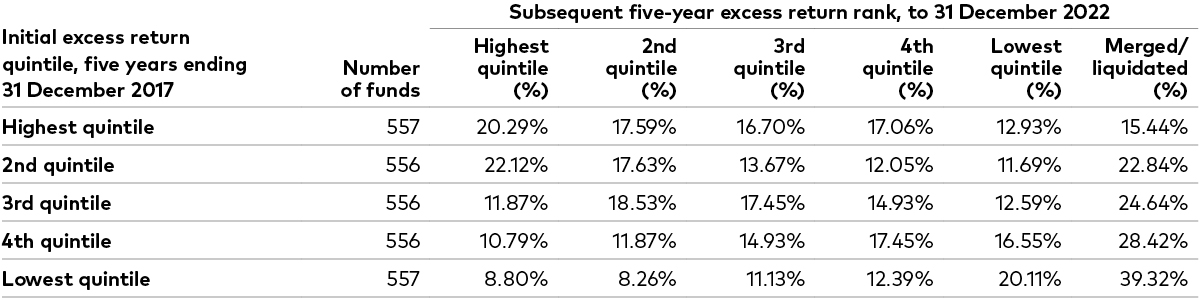

The Challenge of Persistent Outperformance

Longitudinal studies reveal the difficulty of maintaining outperformance in active management. Vanguard data indicates that only a fraction of active funds remain top performers over successive periods. This unpredictability highlights the importance of relying on low-cost index funds for consistent returns.

Actively Managed Domestic Funds Failed To Show Persistent Outperformance, Source: Vanguard

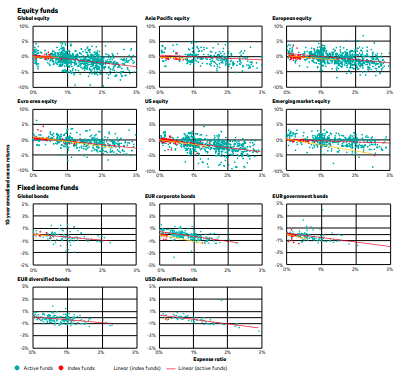

Why Indexing Outperforms

- Cost Advantage

Index funds avoid the need for expensive research and active decision-making, making them far cheaper to operate. This cost efficiency directly benefits investors by enhancing net returns over time. - Diversification and Simplicity

Index funds provide broad exposure to entire markets, reducing unsystematic risk. By tracking a benchmark, they align investor returns with market performance, creating a consistent and predictable investment experience. - Consistency Over Time

As time passes, the compounding impact of low costs becomes increasingly significant. Vanguard’s research demonstrates that index funds outperform the majority of active funds over long periods due to this cumulative advantage.

Higher Expense Ratios Were Associated With Lower Excess Returns, Source: Vanguard

Addressing Misconceptions

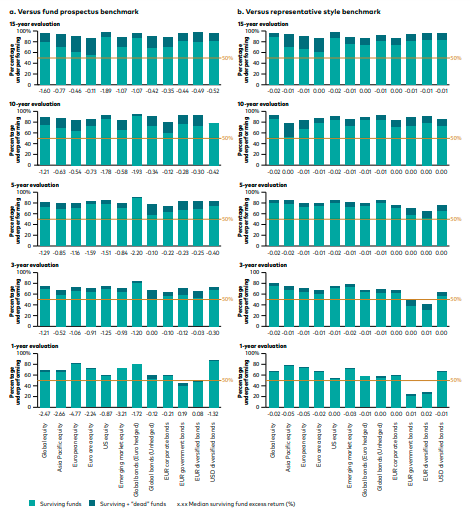

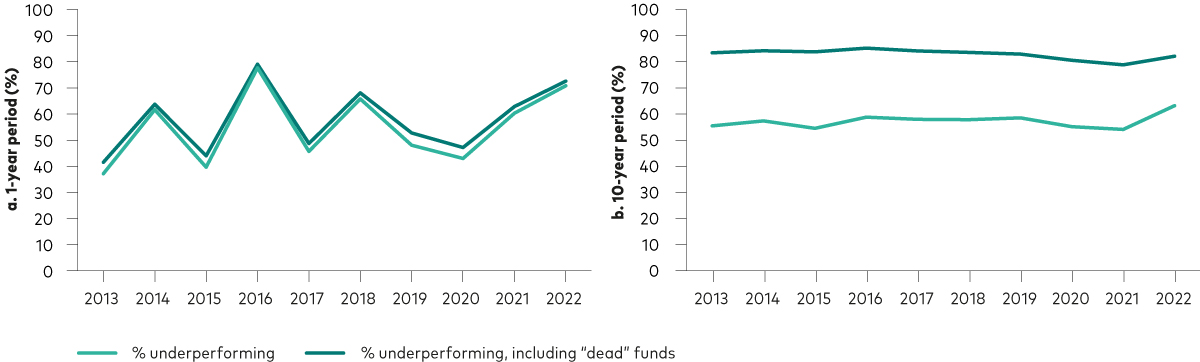

Active management may seem favorable in specific scenarios, such as during market anomalies or due to survivorship bias. However, Vanguard’s data, adjusted for these factors, reinforces the long-term dominance of index investing.

Percentage Of Actively Managed Mutual Funds That Underperformed Versus Their Benchmarks, Source: Vanguard

Real-World Application

For most investors, low-cost index funds represent the optimal balance of simplicity, cost-efficiency, and performance. While active strategies might occasionally outperform, their higher costs and inherent risks make them less practical for consistent long-term growth.

Percentage Of Active Equity Funds Available In Europe Underperforming Over Rolling Periods

Versus Prospectus Benchmarks, Source: Vanguard

Conclusion

Vanguard’s research firmly establishes that low-cost index funds are a cornerstone of successful investing. By focusing on market returns and minimizing costs, investors can achieve long-term financial goals with confidence and simplicity.