Introduction

The Middle East has long been synonymous with oil, powering global industries and shaping geopolitics for decades. But as the world moves towards renewable energy and nations strive for net-zero goals, the future of the region’s oil-driven economy hangs in the balance. With fluctuating oil prices and mounting environmental concerns, one pressing question emerges: What’s next for the Middle East in the ever-evolving energy market?

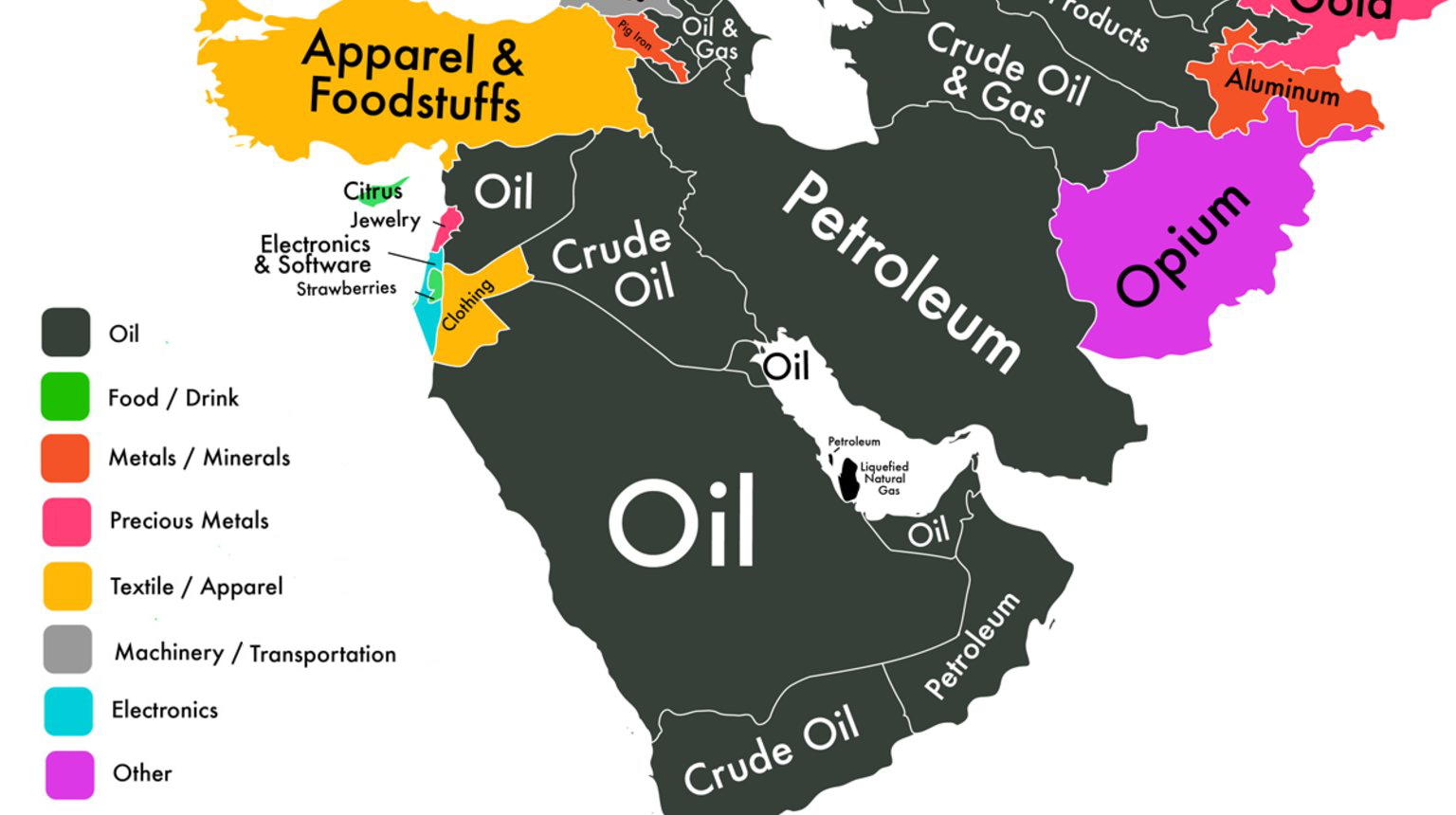

A map of the Middle East highlighting key oil-producing nations like Saudi Arabia, Kuwait, and Iran

Historical Background

The discovery of oil in the Middle East in the early 20th century transformed the region into a global energy powerhouse. Countries like Saudi Arabia, Kuwait, and Iran became key players in the oil market, with the formation of the Organization of Petroleum Exporting Countries (OPEC) in 1960 solidifying their influence. Over the years, oil revenues fueled rapid economic development, urbanization, and geopolitical leverage. However, the region’s heavy reliance on oil exports has also made it vulnerable to market fluctuations and global energy transitions.

A historical photograph of an oil field in Saudi Arabia

Economic Analysis

Causes

Several factors are reshaping the Middle East’s oil economy:

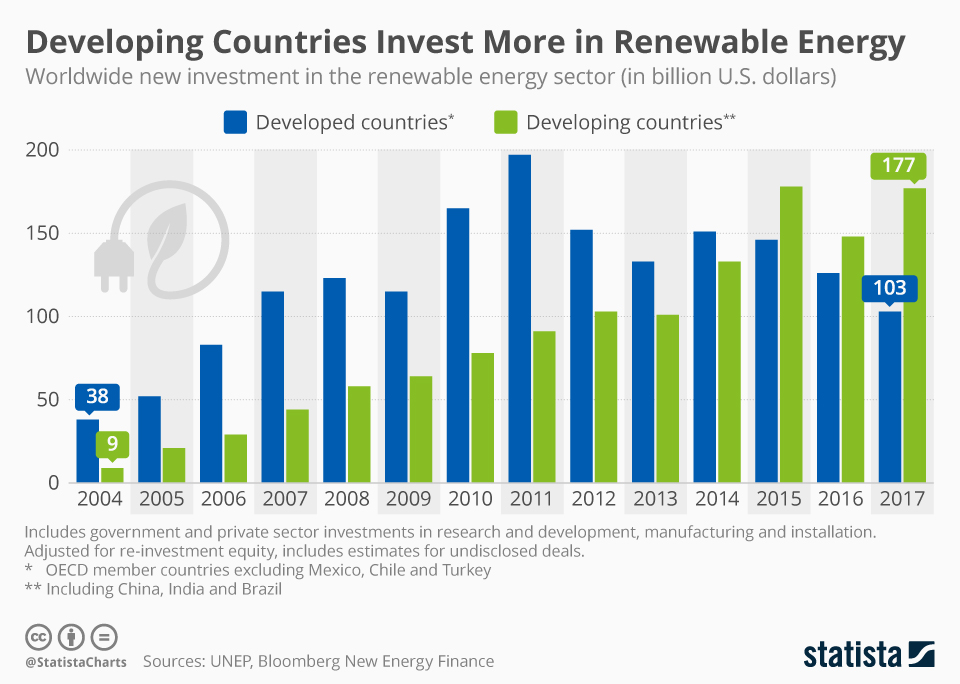

- Global Push for Renewable Energy: Countries worldwide are investing heavily in renewable energy sources to meet climate targets. This shift threatens the dominance of fossil fuels.

- Changing Demand Patterns: The COVID-19 pandemic altered global energy consumption, with a slower recovery in oil demand compared to pre-pandemic levels.

- Technological Advancements: Innovations in energy efficiency and alternative fuels are reducing dependence on traditional oil and gas.

An Infographic Showing The Rise of Renewable Energy Investments Globally, Source: statista

Current Events

Recent developments highlight the region’s shifting energy dynamics:

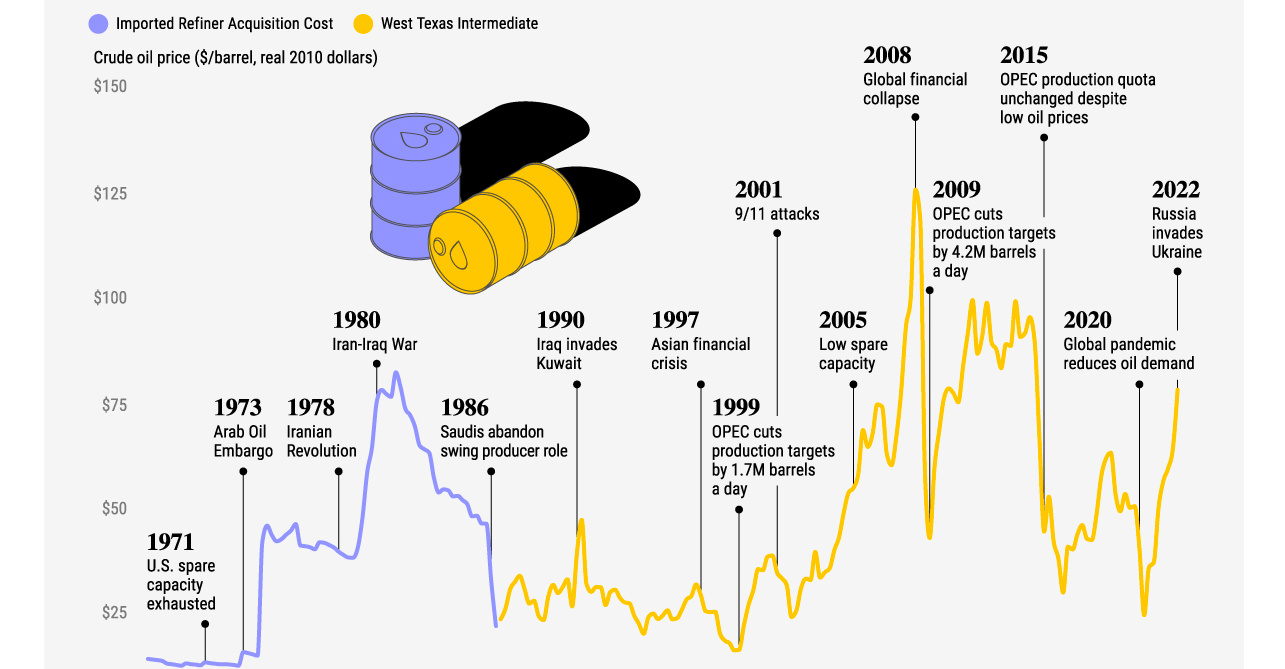

- OPEC’s strategic production cuts to stabilize prices.

- Increased competition from the U.S. shale industry and Russia.

- The impact of the Russia-Ukraine war, which has disrupted global energy supply chains and opened new opportunities for Middle Eastern oil exporters to fill the gap.

Visualizing oil Prices from 1971 until Russia invades Ukraine

Aftermath

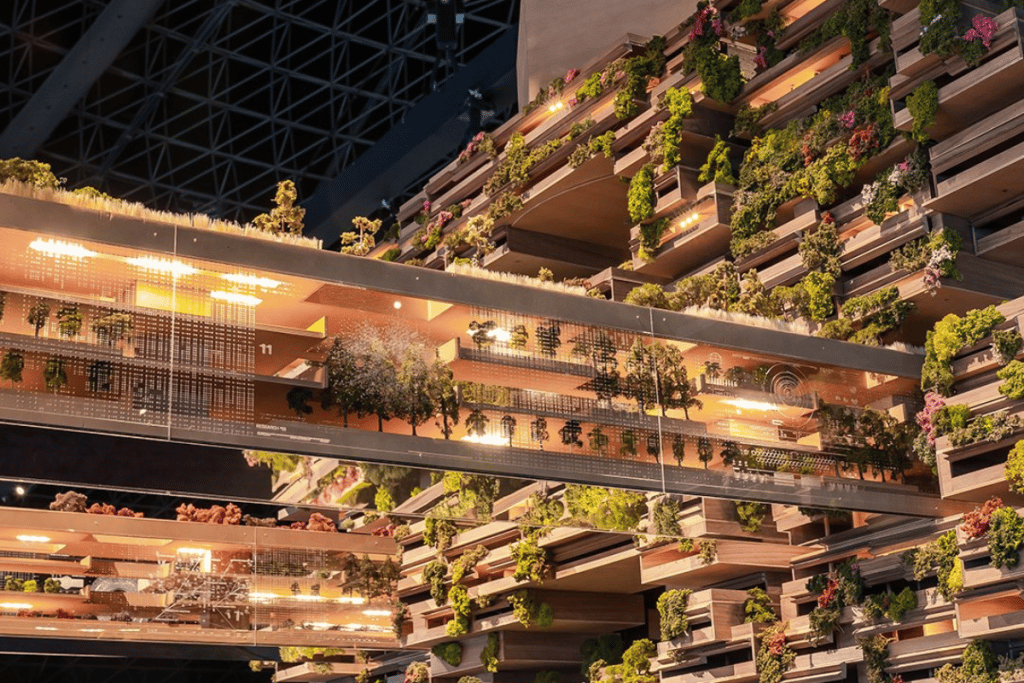

In the short to medium term, Middle Eastern countries are grappling with the dual challenge of maintaining oil revenues while investing in diversification. Saudi Arabia, for instance, has focused on reducing its dependence on oil through its Vision 2030 initiative, emphasizing tourism, technology, and renewable energy.

NEOM The Line And Saudi Arabia’s Ambitious Vision For 2030

Long-Term Effects

Over-reliance on oil could pose significant risks for the region’s economies. However, countries that successfully invest in renewable energy and technology could emerge as leaders in the new energy market. The development of massive solar farms in Saudi Arabia and the UAE’s nuclear energy program are promising signs of this transition.

The World’s Largest Solar Farm in Abu Dhabi

Regional Impact

The evolving energy market affects Middle Eastern countries differently:

- Gulf Cooperation Council (GCC): Oil-rich nations like Saudi Arabia and UAE are leading diversification efforts but still face challenges in sustaining economic growth without oil revenues.

- Non-GCC Producers: Iraq, Iran, and Libya, which rely heavily on oil exports, are more vulnerable to market volatility and slower to diversify.

- Oil-Importing Nations: These countries may benefit from lower oil prices in the long run, reducing their energy import bills and supporting economic stability.

Geopolitical Connections

Energy politics remain a cornerstone of Middle Eastern geopolitics. The region’s relationships with global powers like the U.S., China, and Russia often hinge on energy dependencies. China’s Belt and Road Initiative, for instance, has increased its investments in Middle Eastern energy infrastructure, while the U.S. maintains strategic alliances to secure its energy interests.

Oil On Troubled Water, Source: The Economist

Relatable Examples

- The rising popularity of electric vehicles worldwide such as Tesla, highlights the diminishing demand for traditional fuels. For Middle Eastern countries, this trend underscores the urgency of diversifying their economies.

- Youth unemployment in the region can serve as a stark example of the risks of over-dependence on oil. Diversification initiatives like Saudi Arabia’s Vision 2030 aim to create new job opportunities beyond the oil sector.

Conclusion

The Middle East stands at a crossroads in its energy journey. While oil will likely remain a significant part of the global energy mix in the near term, the region’s long-term economic stability hinges on its ability to adapt to the global energy transition. With strategic investments and forward-looking policies, the Middle East has the potential to lead the way in the renewable energy era. The question remains: Will the region seize this opportunity or risk being left behind in a rapidly changing energy landscape?