Introduction

On August 15, 1971, President Richard Nixon made a monumental announcement that would reshape global economics: the United States was unilaterally suspending the dollar’s convertibility to gold, effectively ending the Bretton Woods system. This event, known as the Nixon Shock, marked a turning point in global financial history, with far-reaching effects on international trade, currencies, and economies, particularly in the EMEA (Europe, Middle East, and Africa) region.

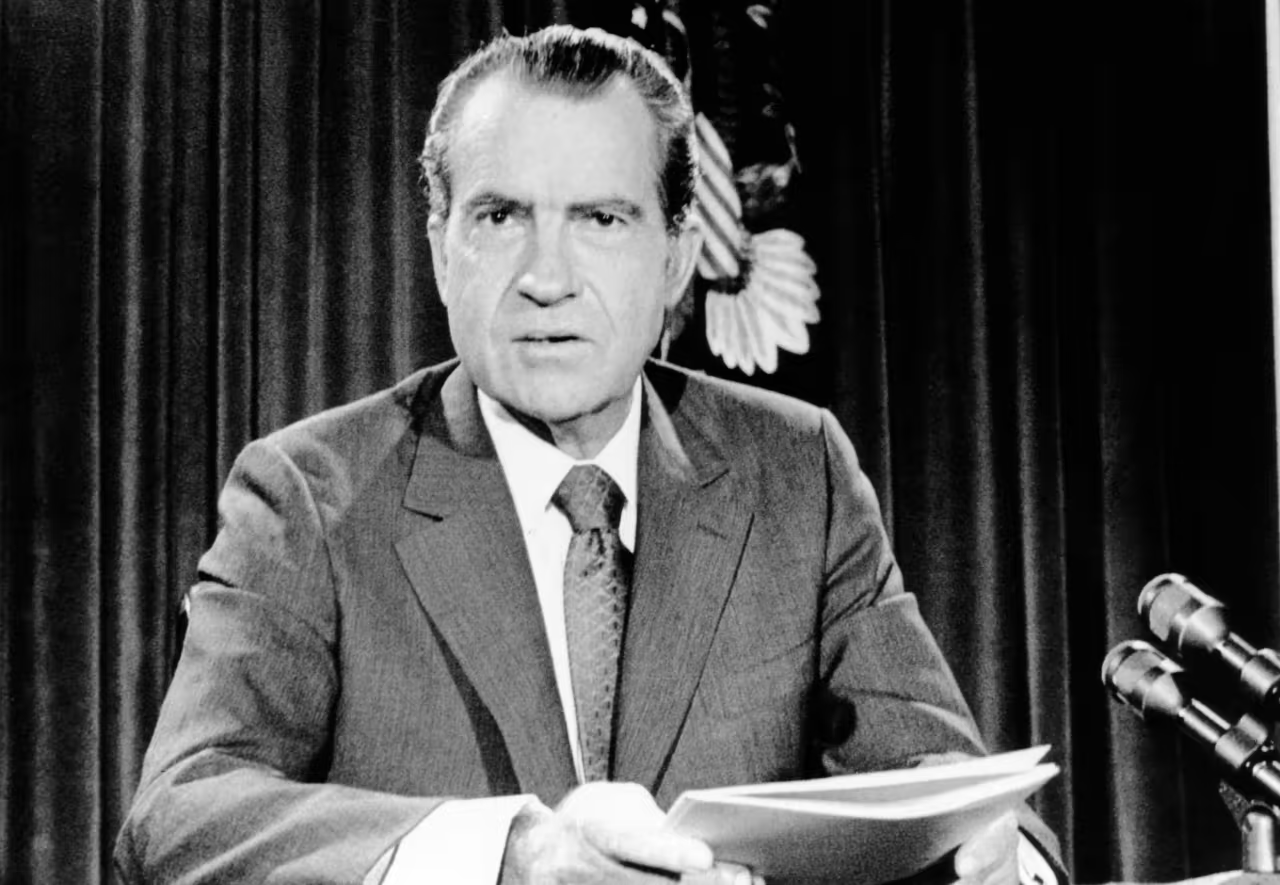

President Nixon’s Announcement Ended The Dollar’s Link To Gold, Source: Financial Times

Historical Background

The Bretton Woods Agreement, established in 1944, tied global currencies to the U.S. dollar, which in turn was pegged to gold at a fixed rate of $35 per ounce. This system provided stability in international trade by ensuring currency values remained predictable.

However, by the late 1960s, the U.S. economy faced significant pressures:

- Rising inflation and deficits due to the Vietnam War and social welfare programs.

- Trade imbalances, with nations like Japan and Germany accumulating large dollar reserves.

- Dwindling gold reserves, as foreign governments began converting dollars into gold, fearing devaluation.

These factors rendered the gold standard unsustainable for the U.S., setting the stage for a drastic policy shift.

The Bretton Woods Era Through The Exchange Rate Lens, Source: EconMacro

The Nixon Shock: What Happened?

On August 15, 1971, President Nixon announced:

- Ending the dollar’s convertibility into gold.

- Introducing a 10% surcharge on imports to protect American industries.

- Imposing wage and price controls to curb inflation.

This move effectively transitioned the world to a fiat currency system, where the dollar’s value was based on trust in the U.S. economy rather than a tangible asset.

Economic Analysis: Causes, Events, and Aftermath

Causes

- U.S. Trade Deficits: Increased imports and decreased exports weakened confidence in the dollar.

- Gold Reserve Crisis: Foreign nations redeeming dollars for gold at an unsustainable rate depleted U.S. gold reserves.

- Geopolitical Pressures: The Cold War and military spending accelerated the economic strain.

Events

- Global Currency Volatility: The immediate aftermath saw currencies like the yen and Deutsche Mark floating freely, leading to uncertainty in foreign exchange markets.

- Dollar Depreciation: With the dollar no longer tied to gold, its value fluctuated based on market dynamics.

Aftermath

- End of Fixed Exchange Rates: Countries adopted floating exchange rate systems, creating volatility in international trade.

- Shift to Fiat Currencies: Governments relied on economic policies, rather than gold reserves, to manage currency values.

Impact on the EMEA Region

The Nixon Shock significantly affected the EMEA region, where many economies relied on the U.S. dollar as a reserve currency:

Immediate Effects

- Oil Prices: Middle Eastern oil exporters, reliant on dollar transactions, faced uncertainty in pricing mechanisms, contributing to the 1973 oil crisis.

- Currency Instability: African and Middle Eastern countries pegged to the dollar saw significant inflation and trade disruptions.

Long-Term Implications

- European Monetary Cooperation: European nations began seeking alternatives to dollar dependency, leading to the creation of the European Monetary System in 1979.

- Debt Challenges in Africa: Many African nations, holding dollar reserves, experienced debt crises as fluctuating exchange rates affected their repayment capabilities.

- Economic Diversification: Middle Eastern oil economies accelerated investments in gold and other assets to hedge against dollar volatility.

Gold Prices Surged After The Nixon Shock, Source: Wikipedia

Geopolitical Connections

The Nixon Shock underscored the interconnectedness of global economies:

- Petrodollar System: Middle Eastern nations’ reliance on the dollar for oil exports grew, solidifying the U.S.’s influence in the region.

- Shift in Economic Power: The weakening of the dollar spurred Europe and emerging markets in the EMEA region to explore economic independence from the U.S.

Relatable Examples

- Imagine a Middle Eastern exporter in 1971 suddenly unable to predict how much their dollar earnings would buy in gold or other goods. The uncertainty prompted shifts in trading practices and reserves.

- In Africa, countries tied to the dollar saw inflation skyrocket, reducing their purchasing power for critical imports.

Conclusion

The Nixon Shock marked the dawn of a new economic era, transitioning the world to fiat currencies and reshaping global finance. Its impact reverberated across the EMEA region, highlighting the vulnerabilities of dollar dependence and sparking movements toward economic diversification and regional cooperation.

For more insights into economic history and its lasting effects, visit Martinos&Co.