Introduction

The US dollar (“USD”) is the cornerstone of the global financial system, dominating international trade, investments, and monetary reserves. Despite periodic challenges from other currencies, such as the euro and the Chinese yuan, the dollar’s dominance remains unmatched. But how did it achieve this status, and what are the implications for the global economy?

Historical Background

The USD’s global prominence began after World War II, when the Bretton Woods Agreement established it as the world’s primary reserve currency. This agreement pegged major currencies to the dollar, which, in turn, was backed by gold. Though the gold standard was abandoned in 1971, the dollar retained its dominance, becoming the primary currency for global trade, oil transactions, and international debt.

A Historical Photograph of The 1944 Bretton Woods Conference, Source: The New York Times

Economic Analysis

Causes of Dollar Dominance

- Trust and Stability: The US has a strong and resilient economy, fostering trust in its currency.

- Global Trade: The dollar is the primary medium for trading essential commodities, including oil (“petrodollars”).

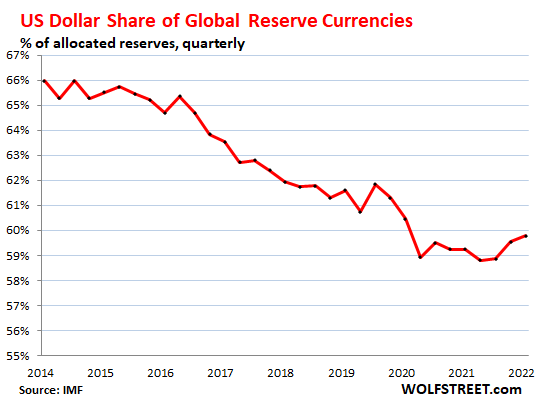

- Reserve Currency: Central banks worldwide hold the USD as their primary reserve currency, accounting for over 58% of global reserves.

- Financial Markets: The depth and liquidity of US financial markets make the dollar indispensable for international investors.

Events Cementing Dominance

Major crises, such as the 2008 financial meltdown, have ironically strengthened the dollar as global investors sought safe-haven assets. Even during economic uncertainty, the dollar’s status as a secure currency remains unchallenged.

Status Of USD As Global Reserve Currency, Source: Wolf Street

Aftermath of Dependence

While the dollar’s dominance offers stability, it also exposes economies to US monetary policies. Countries with debts denominated in USD can face significant challenges during periods of US interest rate hikes, leading to global economic ripple effects.

Long-Term Effects

- Economic Inequalities: Dollar dominance can exacerbate economic imbalances, particularly for emerging markets.

- Geopolitical Tensions: Countries like China and Russia have sought alternatives to reduce reliance on the dollar, sparking debates on de-dollarization.

Regional Impact

The dollar’s dominance significantly affects the EMEA region. For oil-exporting countries in the Middle East, the dollar’s value directly impacts revenue. Similarly, European economies face vulnerabilities due to fluctuations in the USD-EUR exchange rate. Meanwhile, African nations reliant on dollar-denominated loans often struggle with repayment during dollar appreciation.

Geopolitical Connections

US foreign policy often intertwines with the dollar’s dominance. Sanctions against nations like Iran and Russia demonstrate the USD’s leverage in global geopolitics, as access to dollar-based financial systems becomes a critical tool of influence.

Relatable Examples

- Oil Prices: A spike in oil prices due to dollar fluctuations can raise fuel costs worldwide.

- Tourism: For individuals traveling abroad, a strong dollar increases purchasing power in weaker-currency countries.

The Petrodollar System, Source: Bloomberg

Conclusion

The US dollar’s dominance is both a pillar of global stability and a source of significant economic challenges. While alternatives may emerge, displacing the dollar remains a daunting task. Understanding this dominance is crucial for grasping the dynamics of global trade and finance.