Introduction

The idea of printing unlimited money to create wealth might seem tempting, but it’s a recipe for economic disaster. According to APAC Entrepreneur, nations that attempt this face dire consequences, from soaring inflation to loss of economic stability. This article delves into why simply printing money isn’t a viable solution for wealth creation and examines the economic principles underpinning this issue.

The Illusion of Wealth Creation by Printing Money

At its core, money serves as a medium of exchange and a store of value, backed by the production of goods and services within an economy. APAC Entrepreneur explains that printing more money without corresponding economic growth leads to an imbalance between the supply of money and available goods. This phenomenon creates inflation, where the purchasing power of money diminishes, eroding savings and destabilizing economies.

Money Printing, Source: Pinterest

The Domino Effect of Excessive Money Printing

- Hyperinflation: A Threat to Economic Stability

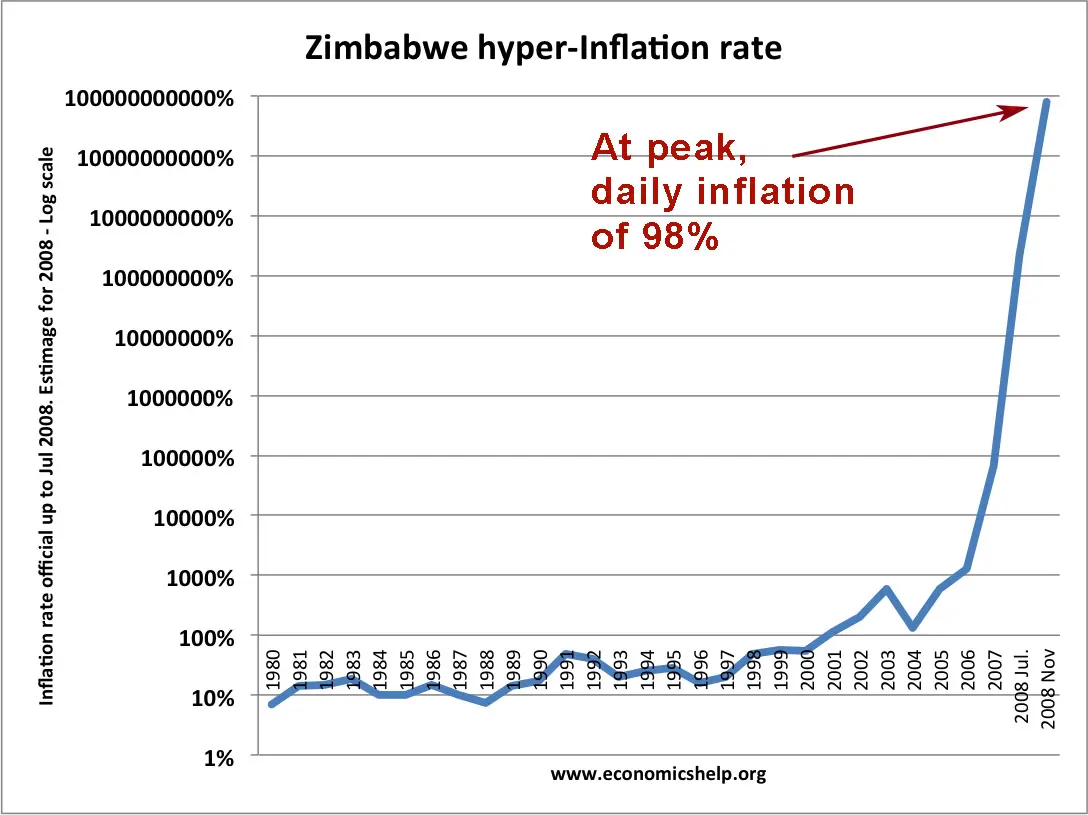

Excessive money printing often results in hyperinflation—a condition where prices increase uncontrollably, leading to economic chaos. Historical examples, such as Zimbabwe in the 2000s and Germany during the Weimar Republic, show how hyperinflation can devastate economies. APAC Entrepreneur notes that these cases highlight the danger of decoupling money supply from economic productivity.

Hyper Inflation In Zimbabwe, Source: economichelp.org

- Undermining Trust in Currency

When a nation prints excessive money, it risks losing the trust of its citizens and international markets. This trust is critical for maintaining a stable economy. APAC Entrepreneur points out that loss of confidence in a currency can lead to reduced foreign investment and economic isolation.

How Nations Create Wealth Without Printing Money

- Economic Growth Through Productivity

Sustainable wealth comes from increasing economic productivity, not merely increasing the money supply. Investments in infrastructure, technology, and human capital are proven methods to boost GDP and create genuine wealth. - Monetary Policies for Stability

Central banks play a crucial role in maintaining a balance between money supply and economic growth. APAC Entrepreneur highlights that well-managed monetary policies can prevent inflation while fostering economic stability.

The Role of Fiscal Discipline

Nations that rely on responsible fiscal policies, rather than printing money, tend to build long-term economic stability. Governments must ensure their expenditures are aligned with revenue generation to avoid budget deficits. APAC Entrepreneur emphasizes that borrowing for productive investments is far more effective than printing money.

Lessons from History

The article from APAC Entrepreneur underscores that the lessons of hyperinflation are clear: money printing leads to economic instability and hardship for individuals. Instead, focusing on real economic drivers such as innovation, trade, and education provides a sustainable path to national prosperity.

Conclusion

According to APAC Entrepreneur, printing money to get rich is not just ineffective—it’s destructive. Economic stability and wealth creation come from productive growth, disciplined fiscal management, and well-executed monetary policies. For nations looking to build prosperity, the focus must remain on strengthening the foundations of their economies, not inflating their currency supply.